us japan tax treaty article 17

A in the case of Japan. One primary benefit of the US-Japan Tax Treaty is the relief from double taxation.

U S Tax Treatment Of Chinese Mandatory Individual Accounts And Social Insurance Pensions Castro Co

Entry into effect a the provisions of the mli shall have effect in each contracting jurisdiction with respect to the tax treaty between japan and the united arab.

. The US-Japan income tax treaty largely follows the model tax convention published by the Organisation for Economic Co-operation and Development OECD of which. The proposed treaty is similar to other recent US. Article 17 of the US-Japan Tax Treaty clearly states.

Therefore if a US person earns public pension from work performed in Japan then they can claim that it is only taxable in Japan. Convention Between the United States of America and Japan for the avoidance of double taxation and the prevention of fiscal evasion with respect to taxes on income signed at Tokyo on March. Protocol regarding the Convention.

In other words the double taxation relief allows a person to claim a credit for taxes paid in the other country to. B in the case of the United States the Federal income taxes. It does not apply to a US Citizen or Permanent Resident of the.

Japan - Tax Treaty Documents. Citizens living in Japan. Therefore if a US person earns.

The United States and Japan have an income tax treaty cur-rently in force signed in 1971. I the income tax. Office of Tax Policy Department of the Treasury Subject.

Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security payments. The proposed treaty would replace this treaty. The proposed new treaty will make an overall revision of the treaty between the two countries which was put in place in.

Article 17 Pension in the US Tax Treaty with Japan Subject to the provisions of paragraph 2 of Article 18 pensions and other similar remuneration including social security. Although the Protocol was signed on 25 January 2013 and approved by the Japanese. Protocol to the US-Japan Income Tax Treaty signed Nov.

And ii the corporation tax hereinafter referred to as Japanese tax. Article 17 of the US-Japan Tax Treaty clearly states. Equity ownership test owned more than 50 by Japanese corporations or resident OR applicable tax rate is 30 shell company or 20 are included in the Japanese parent.

Us japan tax treaty article 17. On 25 January 2013 24 January US time the governments of Japan and the United States signed a new Protocol to the.

Let S Talk About Us Tax Implications Of The Malta Treaty Htj Tax

Usmalta Ca Agreement Targets Pension Planning By Us Taxpayers Pwc

Publication 54 2021 Tax Guide For U S Citizens And Resident Aliens Abroad Internal Revenue Service

The Complete J1 Student Guide To Tax In The Us

3 21 3 Individual Income Tax Returns Internal Revenue Service

Ect Modernisation Perspectives Ect Modernisation And The Denial Of Benefits Clause Where The Practice Meets The Law Kluwer Arbitration Blog

Korea Taxation Of Cross Border M A Kpmg Global

United States Taxation Of International Executives Kpmg Global

Japan Tax Income Taxes In Japan Tax Foundation

Senate Approves Tax Treaties For First Time In Decade The New York Times

Getting Started Bloomberg Tax Bloomberg Tax

This Week In Tax Oecd And Un Digital Tax Proposals Released International Tax Review

Consumption Tax Policies Consumption Taxes Tax Foundation

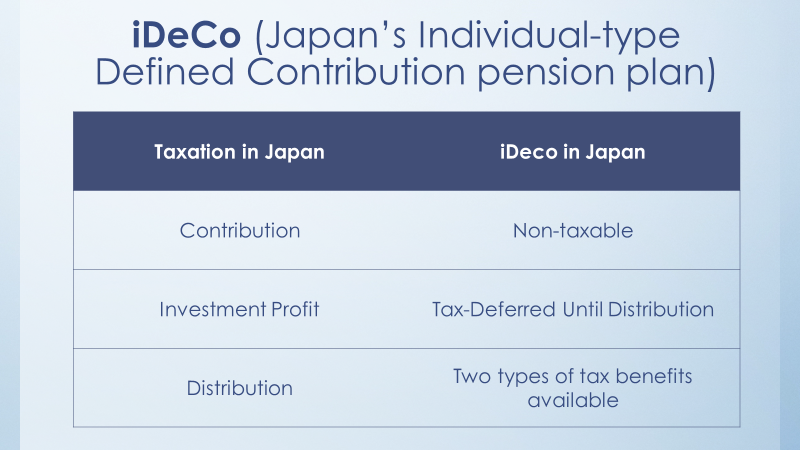

Help Your Japanese Spouse Retire In Japan By Using Ideco Cdh

Tax Treaty Limitation On Benefits Lob Form W8 Ben E International Tax Blog

Roth Ira Taxation For Expats In The Uk Expat Tax Professionals

Pennsylvania Reduces Corporate Income Tax Rate Grant Thornton

Japan United States International Income Tax Treaty Explained

The Ultimate Tax Guide For American Nomads Expats 2021 Nomad Gate